Sep 09, 2017 I have and I use it for intra-day trading. Someone said the success rate is only 1%? That person doesn’t know that. I know he doesn’t know that because Gann never gave us a system to work off. In fact he never told anyone how to implement his theo. Gann used the Wheel of 24, Wheel of 12, and the Square of 9 together. Gann actually had several functions for each numbered wheel and square. Each arrangement involved tuning the market and timeframe using the Law of Vibration and what technique he paired the squares and wheels with.

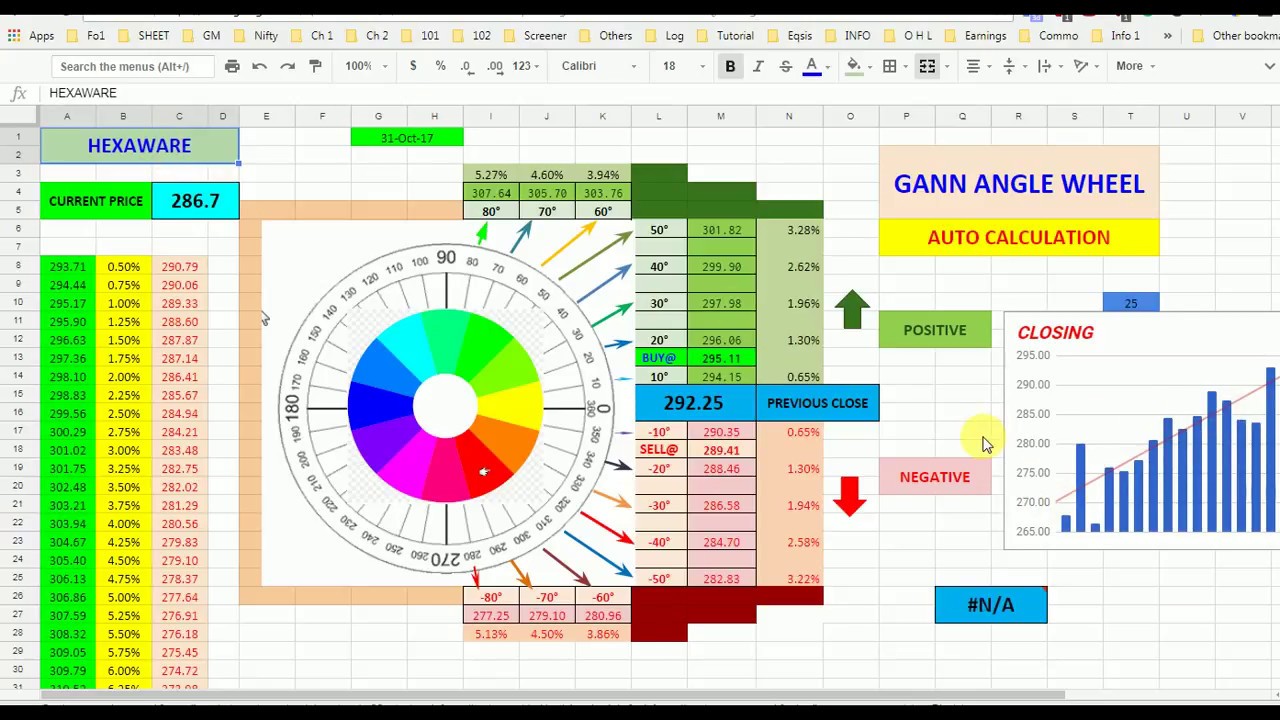

Square of 9 from WD Gann is an unconventional method in Technical analysis which uses angular and geometric relationships among numbers to predict the stock moves. This is a very popular method among intraday traders owing to its accuracy in equities as well as commodities. The square of 9 is actually a spiral or wheel of numbers. The center of the square contains the initial value which is increased clockwise in spiral form. Each number in the square represents an angle relative to the center. In this post, we would understand in detail how to use Gann square of 9 Calculator for intraday trading.

There is an excel sheet attached with the post which would help you to calculate support and resistance levels based on Gann theory. At one point in his trading career, W.D.Gann took three year’s leave to go to the U.K to study the past history of selling prices of Wheat.

During his meticulous studies, he developed some very powerful and innovative techniques, none more so than his use of the tool we call the Square of 9. Gann closely guarded his secrets whilst he was alive, but almost certainly the Square of 9 calculations was pivotal in his trading methods. The Square of 9 was not created by Gann. Download bootsect 32 bit free.

He actually found it inscribed in a temple in India and on the walls of the Great pyramid in Egypt, but he was certainly the first trader to recognize its importance and relevance in market trading. Gann square of 9 calculator is used to generate support and resistance levels for intraday trading.

Breakouts of thee levels would be used to enter trade. The support/resistance levels are generated using the values in Gann square. In order to generate these levels, we need to input the latest trade price or weighed average price in Gann calculator (attached with the post). LTP should be taken after at least half an hour of trade for better results, as there is lot of volatility in market during the first 30 minutes. Once you input this price the Gann levels would be automatically generated.

Bmw tis free download deutsch. Every value in the Gann square is related to the center value. Below are the steps used to calculate these values:.

Calculate the square root of LTP. Let’s suppose LTP=8400, then SQRT(8400)=91.65. Take two integers below and above the square root calculated. In this case they would be 90,91,92 and 93. Square the lowest values out of the 4 calculated above. Put this value at the center of Gann square.

Now, increase 90 by 45 degrees. In numeric terms 45 degrees is equal to 0.125 (360 degree=1). So our required value is 90.125. Calculate square of 90.125, and place it in adjacent block left of center block. SQR(90.125)=8122.52. Increase the value further by 45 degrees.

Find out square of this value and place it at the top of where you placed 8122.52. SQR(90.25)=8145.06. Continue this process by increasing the value by 0.125 for each iteration. Once you complete one level of square, start with the next level with values 91.125,91.25.

Gann Square of Nine Positional and Swing Calculator Gann Positional Formula.Gann Positional / Swing Calculator. Last 3 months/6 months/1 yearHighLowCloseGann Support and Resistance angle: 0 and 0Major Resistance Levels (Trend Reversal Possible)Res 1Res 2Res 3Major Support Levels (Trend Reversal Possible)Sup 1Sup 2Sup 3Swing(Short Term) Resistance and Support Levels - Intermediate TargetsSr.ResistanceSupport12345678. Free Charts.How to use this system1. This calculator is meant for positional and swing trading.2. To use this calculator, you need to select the time frame.3. If you want to trade for 1 month, you should take time frame of last 3 month or 1 month.4. Now for last 3 month, find the high, low and close.

Enter that in the calculator here.5. Calculator will let you know the major trend reversal levels. These levels could act as major support and resistance levels.6.

If price of stock/commodity crosses this major trend reversal levels, then the same trend might continue till the next resistance or support level is not reached.7. If the price of stock/commodity does not cross the major levels or could not sustain those levels for more than 2-3 days, then trend reversal is possible.8.

Intermediate Support and Resistance levels should be used for Swing Trading or BTST.By Using this calculator, you agree to the disclaimer provided at.